Niko-Law provides a wide range of services to expedite both residential and commercial real estate transactions. The firm serves realtors, lenders, mortgage brokers, builders & developers, home buyers and sellers, investors, borrowers and attorneys in the Chicago-land area.

Niko Law LLC thoroughly examines the title history of the property, research any potential municipal violations or liens, review homeowner association rules and regulations, and collaborate with the opposing party’s attorney and broker in order to assure a safe and efficient closing.

Learn More

Congratulations on beginning the process of selling your house! You have made it through the countless “we buy houses for cash” offers and have found a good buyer. Niko Law LLC will help you through the entire process from offer acceptance to closing saving you time and money.

Learn More

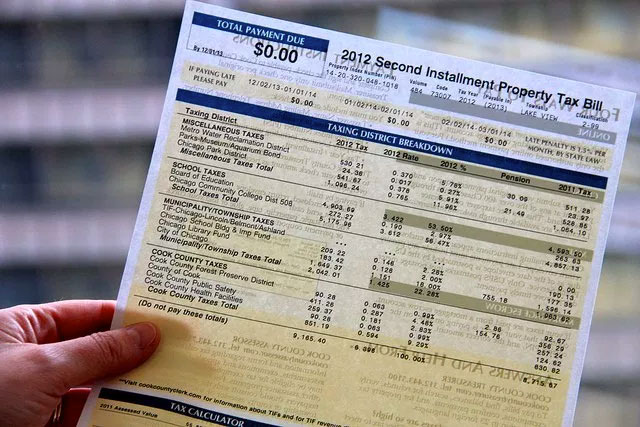

Niko Law LLC will carefully analyze your property tax liability draft all necessary paperwork, and propose any and all available arguments to attempt a reduction in your property taxes.

Learn MoreFind the information you need to purchase your home and stay informed.

Transferring a property title is not as simple as transferring the title of a car. You cannot simply sign it and hand it over to someone else. Property conveyance is a highly detailed legal process requiring the help of a seasoned real estate lawyer.

How much of a credit can you receive from a Seller? How much will your mortgage loan officer allow?

What fees should you expect when purchasing residential real estate? Click to find out!

Closing costs can quickly add up. Do you know how much you will make off the sale of your home? Contact us to find out more.

Did you know Cook County is not required to tell you your home has been over-assessed and you are paying too much in taxes? Find out what you can do about it by clicking here.

Finding the right agent can be tough. What makes a 'good real estate agent'? Click to find out!

Find out how and when to file your exemptions. Do not miss out on your opportunities to save money. Also, do not miss out on exemptions you have missed.

Selling real estate by owner can be tough. See what pitfalls people often run into by clicking here.

If you believe you are overpaying your property taxes and are looking for a way to appeal for a property tax reduction look no further! Cook County property tax appeals on your own can take hours or days with limited success. We want to provide everything that you need to appeal your property taxes and want to make the property tax appeal process as stress free and successful as possible.

Have questions? Not sure where to begin?

The first step is to get in touch!

Jul

Why Do Taxes Increase Every Year? Property taxes can increase for a variety of reasons, and the specific factors affecting your property taxes may vary depending on your location and local government policies. Here are some common reasons why property taxes tend to increase over time: Increased Property Value: If the value of your property […]

Jun

What Happens If I Am Selling My House and My Purchase Gets Cancelled? The process of buying or selling a home can be complex. One of the most common concerns is what happens if a sale falls through after an offer has been accepted, and whether canceling an accepted offer due to unforeseen circumstances can […]

May

Don’t Let Uncertainty Sink Your Deal! The Dangers of “TBD A/I” Writing “TBD attorney review” in a real estate contract can potentially introduce several risks and uncertainties for both the buyer and the seller. Here are some potential dangers: Ambiguity: By leaving the attorney review to be determined later, the contract lacks clarity on crucial […]